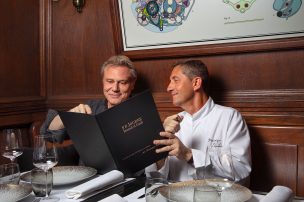

In cooperation with award-winning chef Dominique Gauthier, F.P. Journe opened the fine dining brasserie ‘F.P. Journe Le Restaurant’.

On 6 November, Christie’s held what the auction house described as one of the most significant private collections it has ever auctioned. Exceptionally rare and historically important: this is the best way to describe the impressive collection of Mohammed Zaman, a collector from the Sultanate of Oman, who amassed the pieces over the last 40 years. This also explains the particular rarity of the Christie’s Passion for Time auction, which is the work of a single collector who assembled the watches according to his own taste and personal appreciation of watchmakers. The result is a diverse collection of watches verging on mythical status, from the Rolex GMT Master worn by Marlon Brando in the film Apocalypse Now to Philippe Dufour’s masterpiece Grande et Petite Sonnerie, aka the first wristwatch with a Grande Sonnerie complication.

The collector from the Sultanate of Oman, Mohammed Zaman

Thus, alongside many others, I joined the livestream punctually at 10 a.m. on 6 November, so as not to miss the eagerly awaited Christie’s Passion for Time auction. But Christie’s kept us waiting for almost an hour – not the most promising start. When the auction finally began, it was announced that the lots were now subject to a warranty agreement with an unknown third party, and the estimates had been adjusted accordingly. These new estimates were updated live, and announced before each lot. It was immediately noticeable that the estimated values of the lots were revised upwards for almost every watch, sometimes by tens of thousands. While the cumulative original lower estimate of all wristwatches was CHF 18,630,000, the updated lower estimate was now CHF 28,745,500. To put this into perspective, this represents an average increase in the lowest estimates of 54.30 percent. The change becomes even more questionable when you realise that the original highest estimate of the lots was CHF 33,995,000.

The estimated value of this Rolex Oyster Perpetual “Stelline” has been updated from CHF 1 to 2 million to CHF 1.8 to 2.8 million

In order to understand how this colossal price change could have possibly come about, I contacted Christie’s shortly after the auction. When I asked why the updated estimate differed so much from the original estimate in the Passion for Time catalogue, Christie’s replied: “We received last minute interest from a third party willing to guarantee the auction, as communicated before the auction. As the levels he wished to guarantee were higher than the low estimates of the catalogue, we had to revise them to his levels in order to communicate them transparently.” However, this statement raised more questions for me than it answered. Why would the third party want to guarantee an amount that is higher than Christies’ lowest estimates? What advantage could they gain from this?

Before I deal with the question of what advantage the guarantee could offer the third party, I would like to go into more detail about why such a guarantee became necessary in the first place. At first glance, guarantees are a clever way to minimise the risk of loss between the auction house [Christie’s] and the seller [Mr Zaman], who receives a minimum price guarantee for his watches. Here, a third party assumes a position to place an irrevocable bid on the lots – this is known as a third-party guarantee. If no further bids are received, the seller is guaranteed to receive a minimum price, regardless of the outcome of the sale.

To understand how the third party might benefit from this system, we need to bear in mind that third parties are often individuals or communities of interest pursuing their own financial interests. The guarantor, as with Christie’s, is compensated for sharing the risk. In most cases, the compensation of the third party is based on a fixed compensation fee, or if the lot is sold at a higher price, on a portion of the profit. This fact also answers the question as to why the third party was willing to guarantee more than Christies’ lowest estimates: the more risk a third party is willing to cover, the greater the potential compensation.

During the auction, another sequence of events occurred that raised questions. Around 70 percent of the lots were sold at the revised low estimates and many of these went to the same paddle, number 1013, suggesting that either the third party himself or someone from his community of interest was behind this lot. On the day of the auction, the guarantor is permitted to submit a higher bid for the lot than his irrevocable written bid. Although the third party is obliged to disclose to Christie’s their financial interest in a lot and those they are advising on the lot, it remains ambiguous as to whether this has actually taken place.

Marlon Brando’s Rolex GMT Master is a prime example of this process. It was worn by Brando during the filming of Francis Ford Coppola’s 1979 cult film Apocalypse Now and was estimated at CHF 1,000,000 – 2,000,000 in the original catalogue. After the third-party guarantee, the updated estimate was CHF 3,750,000 – 6,500,000. It eventually realised a total price of CHF 4,582,500, an amount that covered the corrected low estimate plus fees.

The estimated value of Marlon Brando’s Rolex GMT-Master has been updated from CHF 1.0 to 2.0 million to CHF 3.750 to 6.5 million

Third-party guarantees have been a hotly debated topic in the art market for years. As a mixture of risk protection for the auction house and speculation for the third party as well as other bidders, they hold a significant amount of power. However, this combination results in several problems. The concept of a guarantee ensures that the lot (in this case, the wristwatch) is reduced to a speculative object whose value is not defined by its rarity, condition, or historical value, but by how much profit it can generate. The guarantee is presented as a perfect investment opportunity: if a guarantor buys a lot, they receive a financing fee from the auction house and therefore pay less for the lot than all other bidders. If another bidder buys the desired object, the third party still earns from it. The worst-case scenario, however, would be if the lot doesn’t sell – then you might find yourself stuck with an unwanted lot.

The estimated value of George Daniels Platinum Anniversary No. 00 has been updated from CHF 1.2 – 2.4 million to CHF 1.5 – 2.8 million

In addition, the third party knows the guarantee they have promised and its conditions, and can therefore place themselves in a potentially advantageous position, which, in turn, can lead to an uneven playing field. All in all, all of these processes could distort the market for wristwatches and artificially drive up prices.

The tactic of announcing a guarantor at the last minute is not new, either. This procedure serves to actually further the lack of transparency and, if necessary, to overwhelm other bidders with information. Christie’s would have done well to set a deadline to avoid such unexpectedly higher estimates shortly before the auction. As stated in the ‘Geneva Conditions of Sale Buying at Christie’s’, it is possible to mark lots that are subject to a third-party guarantee agreement with a specific symbol in the catalogue before the auction. This was not the case in the original catalogue of the Christie’s Passion for Time auction, but would have no doubt contributed significantly to improving transparency in this case.