To mark the 170th anniversary of Cartier's first watch, the Maison is launching a Tank Louis Cartier Platinum limited to 170 pieces, exclusively for the European market.

When Swatch announced its unprecedented collaboration with Omega last year, it triggered criticism, curiosity, but above all, surprise. Surprise that Omega, a brand that usually stands for watches in the higher-priced segment, was launching a significantly more affordable watch. The MoonSwatch, a €250 watch made of bioceramic and inspired by the famous Omega Speedmaster Professional, now aroused the interest of people who previously would not have considered a watch from this brand. Between social media and tabloids, voices were raised criticising the brand’s choices, accusing it of deviating from its roots and washing out the product range. But as we know today, the MoonSwatch has long since become a box-office hit which, rather than damaging Omega’s brand image, actually led to an increase in demand for ‘real’ Omega Speedmasters.

With almost one million MoonSwatches sold last year and probably more than two million this year (according to Swatch Group figures), the collaboration has proven that a polarising cooperation between two very different brands within the Swatch Group can be beneficial for both – especially in terms of sales and brand awareness. The Swatch Group’s 2023 half-year report speaks clearly in this regard: the Group achieved net sales of CHF 4 019 million in the past six months, which represents impressive growth of 18 % compared to the previous year. Even more significant and indicative of MoonSwatch’s success, however, is the fact that double-digit growth was recorded in all price segments of the watch and jewellery sector, with the lowest price segment showing the strongest growth. All in all, this means that the largest Swiss watch manufacture is well on its way to a new record turnover in the current year, and that the MoonSwatch has made a significant contribution to this.

After the first chapter – the MoonSwatch – the Blancpain X Swatch is now the sequel. It, too, follows the proven formula: the diameter and design were taken from a Fifty Fathoms model from 2007. The materials are also typical Swatch, with a case made of Bioceramic. But don’t let that fool you, because the Bioceramic Scuba Fifty Fathoms is a real diver’s watch. As it should be, the Bioceramic Scuba Fifty Fathoms is impervious even at a depth of 91 metres.

The movement, on the other hand, triggered a number of speculations in advance, because it is of special significance for Blancpain. As the oldest watch brand in the world, Blancpain embodies the tradition of the mechanical watch like no other. Additionally, it marked the return of Swiss watchmakers to their original values after the quartz crisis nearly destroyed the Swiss watch industry. After Jean-Claude Biver revived the brand in the early 1980s, marketing communication culminated in this slogan: “There have been no quartz watches at Blancpain since 1735. Nor will there ever be”. That is why watch lovers were all the more pleased that the Bioceramic Scuba Fifty Fathoms, unlike the MoonSwatch, has a mechanical movement instead of a quartz mechanism. This is the Sistem 51 movement, which gets its name from the number of its components.

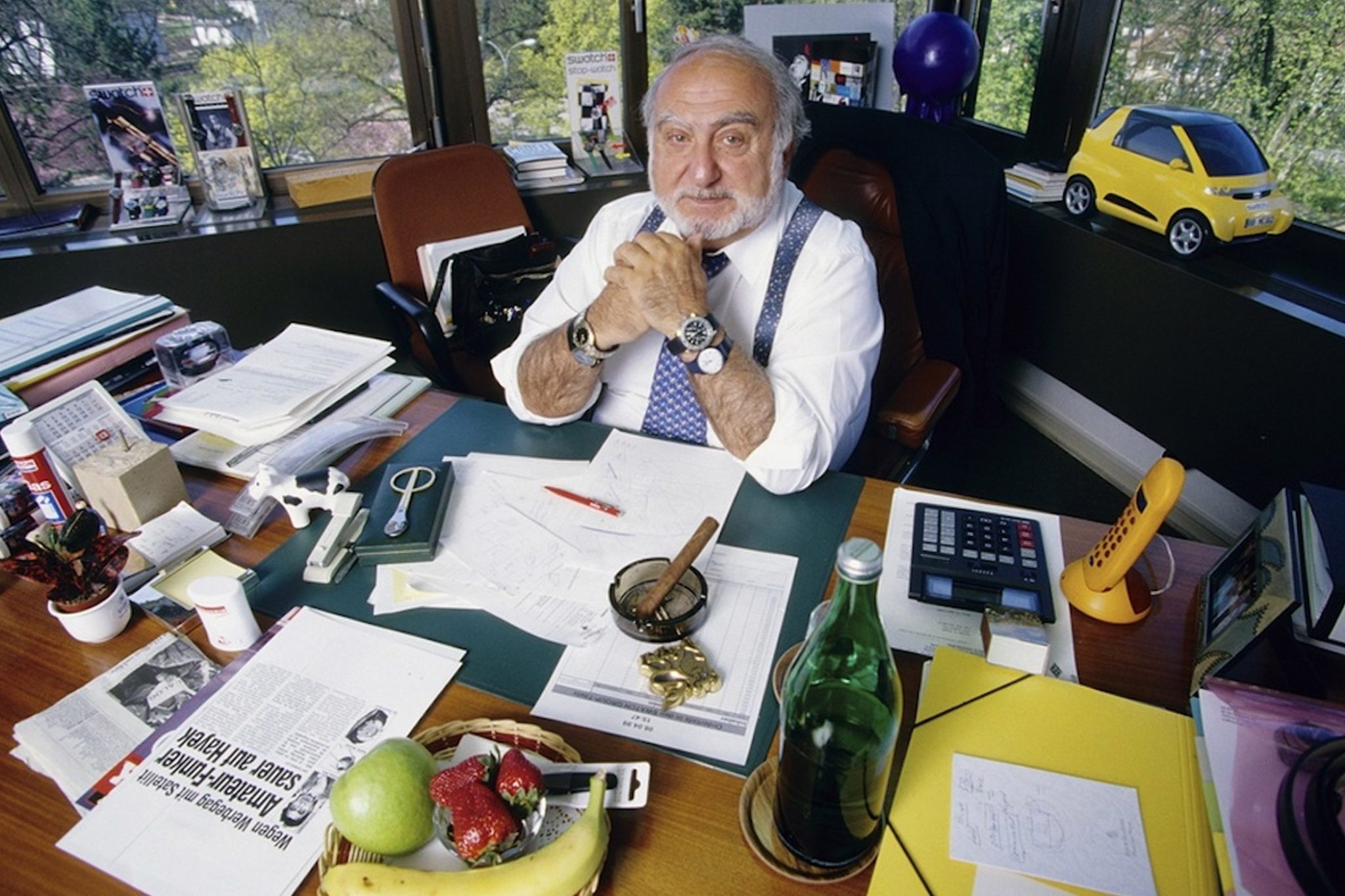

In order to answer the question of whether further collaborations between brands within the Swatch Group make sense, it is important to understand the strategy behind them. Let’s take a little step back in time, to when the Swiss watch industry was threatened by the quartz crisis. At that time, new types of electronic watches with quartz technology ensured that watches with mechanical movements were almost completely displaced. As a result of the quartz crisis, around 60,000 jobs were lost in Switzerland, and it took until the early 1980s for the then management consultant, Nicolas G. Hayek, to herald the rescue of the Swiss watch industry. He believed that the Swiss watch industry lacked entrepreneurial personalities with “courage, imagination and foresight”.

For this reason, the consultant suggested that the companies concerned should not be sold, but rather restructured, and that SSIH (Société Suisse de l’Industrie Horlogère SA) and ASUAG (Allgemeine Schweizerische Uhren AG) should be merged into a holding company. In the end, it was Hayek who initiated the production and distribution of a low-priced “Second Watch” (Swatch for short). The positioning with the innovative Swatch plastic models in the lower price segment finally created a new wind in the industry and fresh sales in the coffers.

Nick Hayek, Nicolas G. Hayek’s son and CEO of Swatch, follows this historical example with his strategy of collaborations within the Swatch Group. Just like his father, he does not strive to focus exclusively on expensive market segments, but on offering products for a broad section of the population instead of making them only for elites. So can we expect a further democratisation of the high-priced models of Swatch brands? At least the figures speak for the strategy, because as the statistics of Swiss watch exports of the Federation of the Swiss Watch Industry FH indicate, watches with export prices of up to 200 Swiss francs (or retail prices of up to 600 Swiss francs) continued to record a strong increase of +11.6% in August. By comparison, the most expensive timepieces recorded an increase of +1.5 %.

The challenge, however, will be completely different. The success of the MoonSwatch was based to a considerable extent on its originality and freshness, whereas the Swatch x Blancpain collaboration, which has now been launched, seems more like a sequel. Further follow-ups to this concept could run the risk of relying too heavily on the tried and tested formula for success and seem like repeats. Of course, there are examples of sequels that exceed expectations and maintain or even increase the quality of the original. However, it remains to be seen whether Swatch will find the right balance between continuing the popular concept and creating something new.