Wempe is presenting the Iron Walker Chronograph 46 in three variants that have a case made of carbon.

The luxury goods group LVMH has just promoted Frédéric Arnault to CEO of the LVMH Watch Division, and Julien Tornare to the new CEO of TAG Heuer, as the group continues to massively expand its competencies in the watch segment. But what impact might this have upon the entire watch industry? What is owner of LVMH Bernard Arnault’s strategy? We dared to make a forecast.

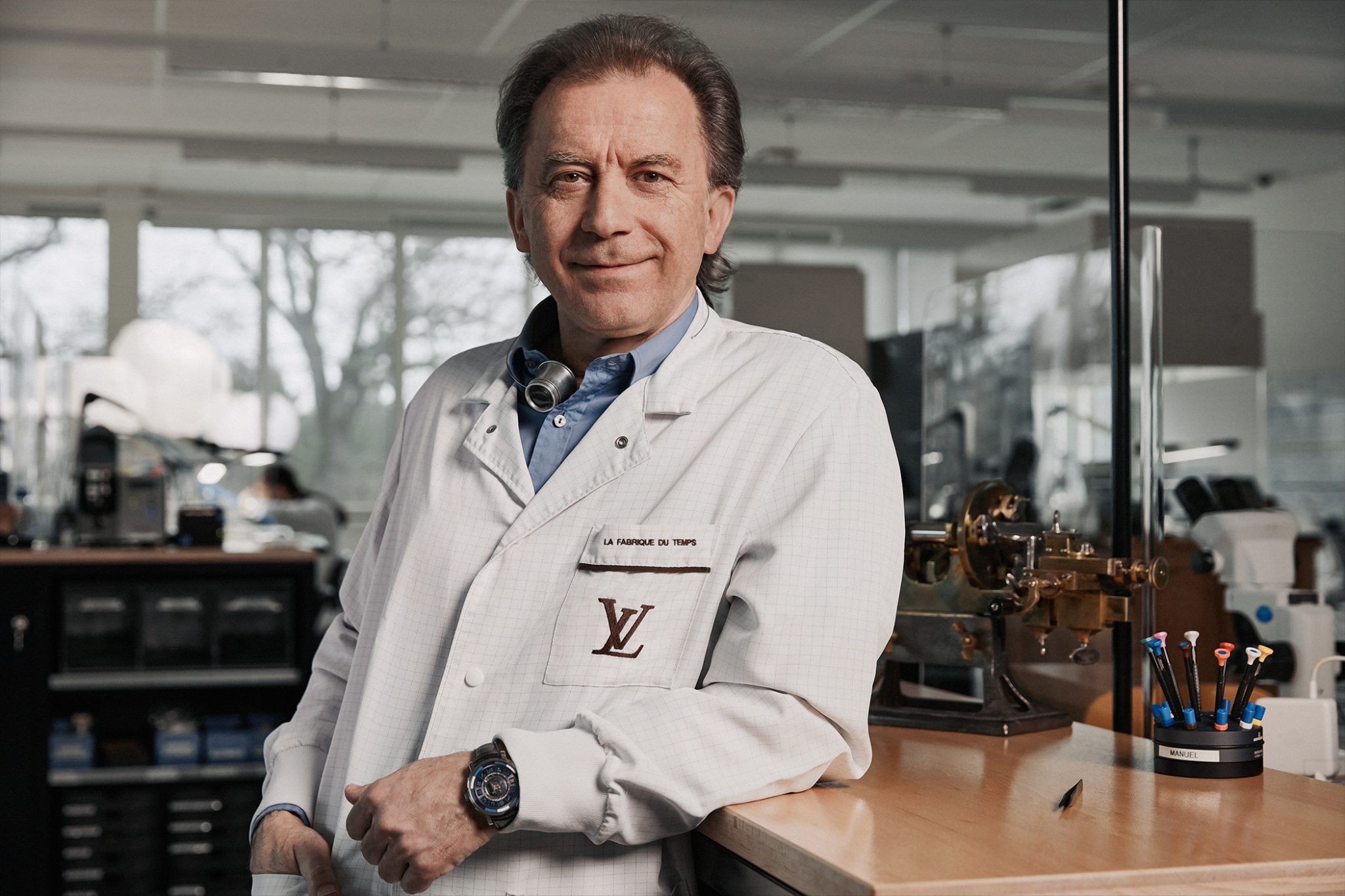

Frédéric Arnault – CEO of the LVMH Watch Division (Left)

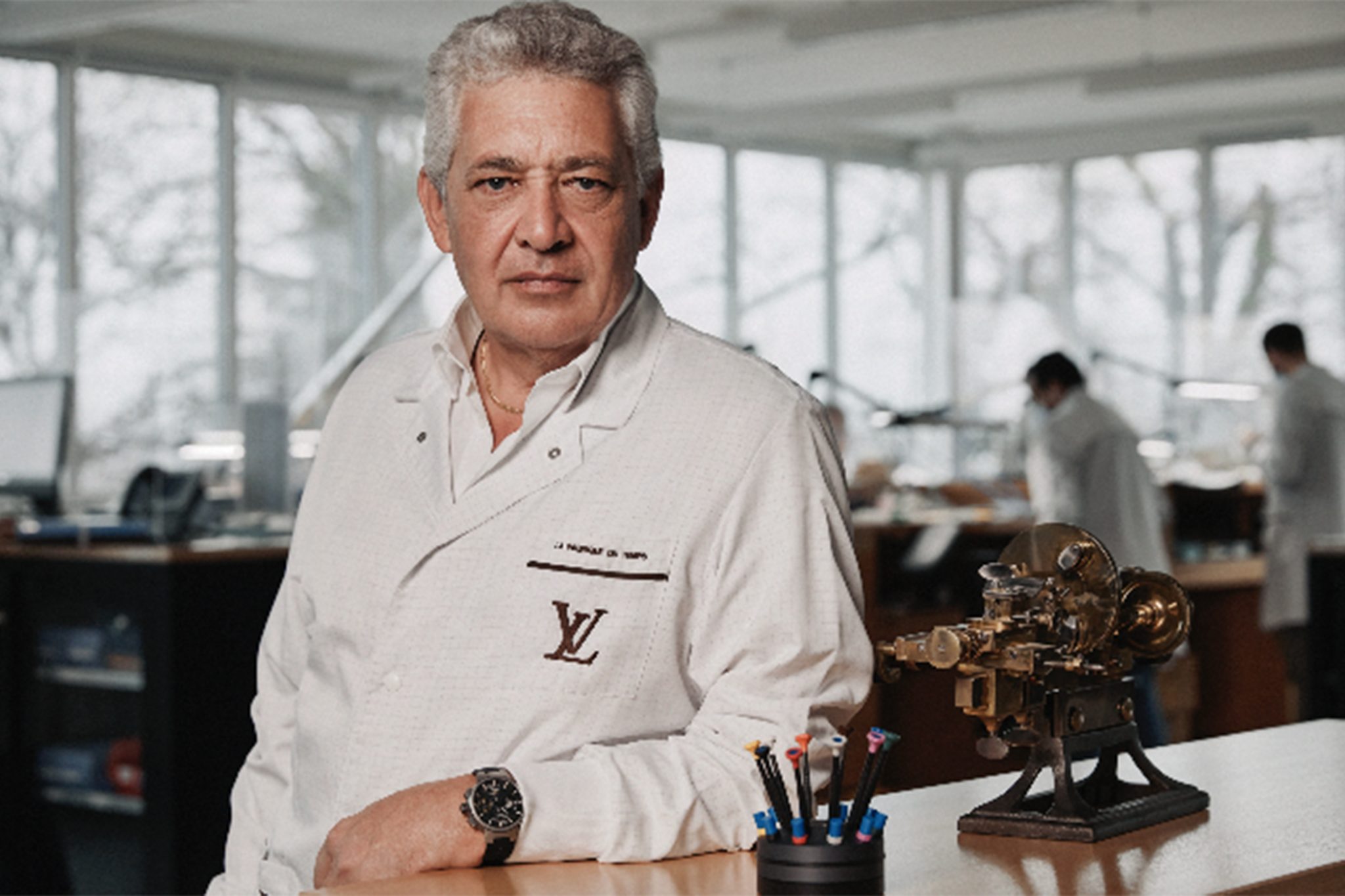

Julien Tornare – CEO of TAG Heuer (Right)

It was in October 2011 that the LVMH Group acquired the movement manufacturer La Fabrique Du Temps – a highly conceptual movement producer that was founded in 2007 by the renowned watchmaking duo Michel Navas and Enrico Barbasini. From this point forth, Louis Vuitton’s watches would be raised to a whole new technical level. Among others, both Master Watchmakers previously worked for Audemars Piguet and Patek Philippe, as well as for Gérald Genta in the 1980s and 1990s, where they were responsible for the minute repetitions, tourbillons and high complications. In March 2012, LVMH bought the two dial manufacturers, ArteCad and Léman Cadran, to further expand its own watchmaking skills. In October 2014, Louis Vuitton then solemnly inaugurated the 4,000 square metre watch manufacture in Meyrin, a suburb of Geneva, under the name “La Fabrique Du Temps Louis Vuitton” – yet of course still under the direction of Navas and Barbasini. April 2023 marked a new chapter for La Fabrique Du Temps Louis Vuitton, by which production should only focus upon highly complicated watches in small quantities.

Michel Navas und Enrico Barbasini

But what does all this have to do with the story? Last Friday, the LVMH Group announced that Frédéric Arnault will become the new CEO of LVMH Watches, meaning the CEOs of TAG Heuer, Zenith and Hublot will report to him from now on. Julien Tornare, CEO of Zenith since 2017, has now become the new CEO of TAG Heuer, while Benoit de Clerck, so far COO (Chief Operation Officer) of Panerai (Richemont) will take over the Tornare’s tasks. Meanwhile, Ricardo Guadalupe will remain in his executive chair at Hublot.

Ricardo Guadalupe – CEO of Hublot

The latest strategic decisions thus confirm what was already initiated in 2011. The LVMH Group wants to massively expand its expertise in the luxury watch segment – and perhaps even become the sole world market leader in the long term. It is not for nothing that rumours are already circulating that LVMH could buy up the Richemont Group (e.g. IWC, Piaget, Panerai, Cartier, Vacheron Constantin, Jaeger-LeCoultre, Montblanc). Richemont owner Johann Rupert has not yet explicitly clarified who might succeed him. It’s a rather different case for the Arnaults, who own around 48 percent of the LVMH shares. LVMH patron Bernard Arnault has successively brought all his five children into the company in recent years. The oldest daughter, Delphine Arnault, has been head of Dior since last year. Antoine Arnault, the eldest son, is head of LVMH’s communications, as well as the chairman of Berluti and Loro Piana. Alexandre Arnault holds the position of Executive Vice President of Tiffany & Co., while the youngest offspring, Jean Arnault, has been CEO of the Louis Vuitton watch line since 2021, which made a brilliant restart last year. Not to forget that LVMH has acquired the rights to Gérald Genta and Daniel Roth, which are now gradually also being revived by Jean Arnault under the watchmaking direction of Navas and Barbasini, and are two brands that enjoy high recognition worldwide among watch enthusiasts. The luxury brand LVMH also plans to be at the forefront of Haute Horlogerie.

Jean Arnault, has been CEO of the Louis Vuitton watch line since 2021

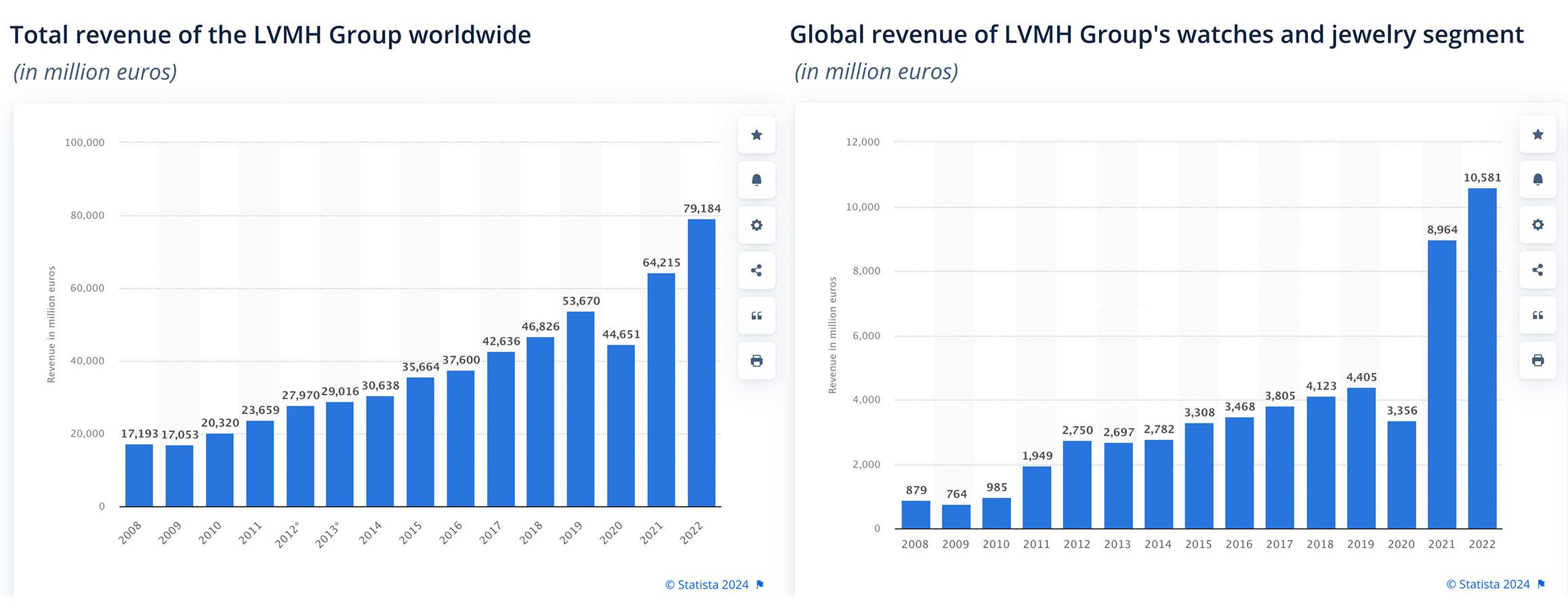

What’s more, the business is pretty lucrative. As well as a total turnover of around 80 billion euros (source: Statista) in 2022, LVMH generated around 10.6 billion euros in sales with watches & jewellery alone – 18 percent more than in the previous year 2021. LVMH, founded in 1987, only started the watch business with TAG Heuer in 1999. It is not known how much the company actually generates purely with watches, but the signals to the industry are unmistakeable. Frédéric Arnault’s new position as CEO of the LVMH Watch Division was created so that he can steer the development and growth of the brands in the right direction and Bernard Arnault can ensure that it remains a family business. Of course, Bernard Arnault could also have hired a manager outside the family, but it is slowly but surely time for Bernard Arnault to prepare his own successor – and this is only possible if he promotes and places his children in top functions. The only downside for the youngster: Frédéric Arnault still reports to Stéphane Bianchi, who continues to supervise both divisions as CEO of the Watches & Jewellery Division. In all fairness, Frédéric Arnault is only 29 years young.

And why the reshuffle at Zenith and TAG Heuer? Julien Tornare can be credited for the success of Zenith in recent years. Tornare has revived the power and popularity of the El Primero, having consequently managed to ignite a new desire for the brand and create a high demand for certain models with clever new products. It is the ideal (internal) cast for the larger brand TAG Heuer, which in recent years has not always found it easy to transport its success from the past to modern times. Frédéric Arnault, who has headed the brand since 2020, managed to anchor the brand more in people’s minds again, not least with the help of Ryan Gosling and amusing advertising campaigns.

Tornare’s successor, Benoit de Clerck, will probably not bring a breath of fresh air to Zenith, but rather ensure that the brand remains on the chosen path. De Clerck is already the second manager to be recruited by LVMH from competitor Richemont. In 2017, Julien Tornare moved from Vacheron Constantin to Zenith. Let’s see if new personality de Clerck pays off again – and if Tornare will continue to grow beyond himself.

As far as the Arnault family is concerned, it remains exciting to observe how the “Watches & Jewellery” business will develop in the next few years and how the competitors Richemont and Swatch Group (e.g. Omega, Breguet and Blancpain) prepare for the future. Because even in the luxury world, money is not everything – it requires smart strategic decisions for each individual brand and its highly sensitive clientele. And then there is the follow-up question for Bernard Arnault. With five children in the company, the pressure among themselves is great, which could positively or negatively affect the strategic orientation of the individual business areas. In an interview with the New York Times, Bernard Arnault recently said, “The best person inside the family or outside the family should be one day my successor. But it’s not something that I hope is a duel for the near future.”