To mark its 50th anniversary, Girard-Perregaux presents the Laureato Fifty model in a limited edition with a completely new movement. Here's the whole history.

The pre-owned watch market is exciting, diverse and multifaceted. This applies not only to the range of watches on offer. Here you will find an overview of the wide range of products available – from large online platforms to trusted jewellers – as well as an outline of the eventful history of a genuine growth market.

The hype is over. Serious watch collectors and enthusiasts can finally rest easy. The speculators, also known as ‘flippers’, have moved on, and the pre-owned watch market, after years of overheating, has now cooled and settled.

Pre-owned watches – that this would one day become a huge growth market was hardly imaginable twenty or thirty years ago. I still remember the first attempts on the then kaleidoscopic marketplace eBay and by a few jewellers, which were met with a mixture of curiosity and pity by most industry insiders. As a means of trade-in to sell a new watch, it seemed quite nice for jewellers. But real sales potential? Hardly anyone saw it. Customers, after all, always wanted the newest models – or so the near-unanimous and mistaken belief went. It will never catch on. Many thought the same in the early days of the Internet.

Today, we know that both of them have developed relentlessly and are now indispensable. The booming business of pre-owned watches is closely linked to the World Wide Web, and experts estimate that it has grown by around 400 per cent over the past two decades.

The field of providers is also steadily expanding. Not only are brands gradually introducing their own certified pre-owned (CPO) programmes – the most well-known is probably Rolex – but online retailers, platforms, and jewellers are increasingly participating in the pre-owned market.

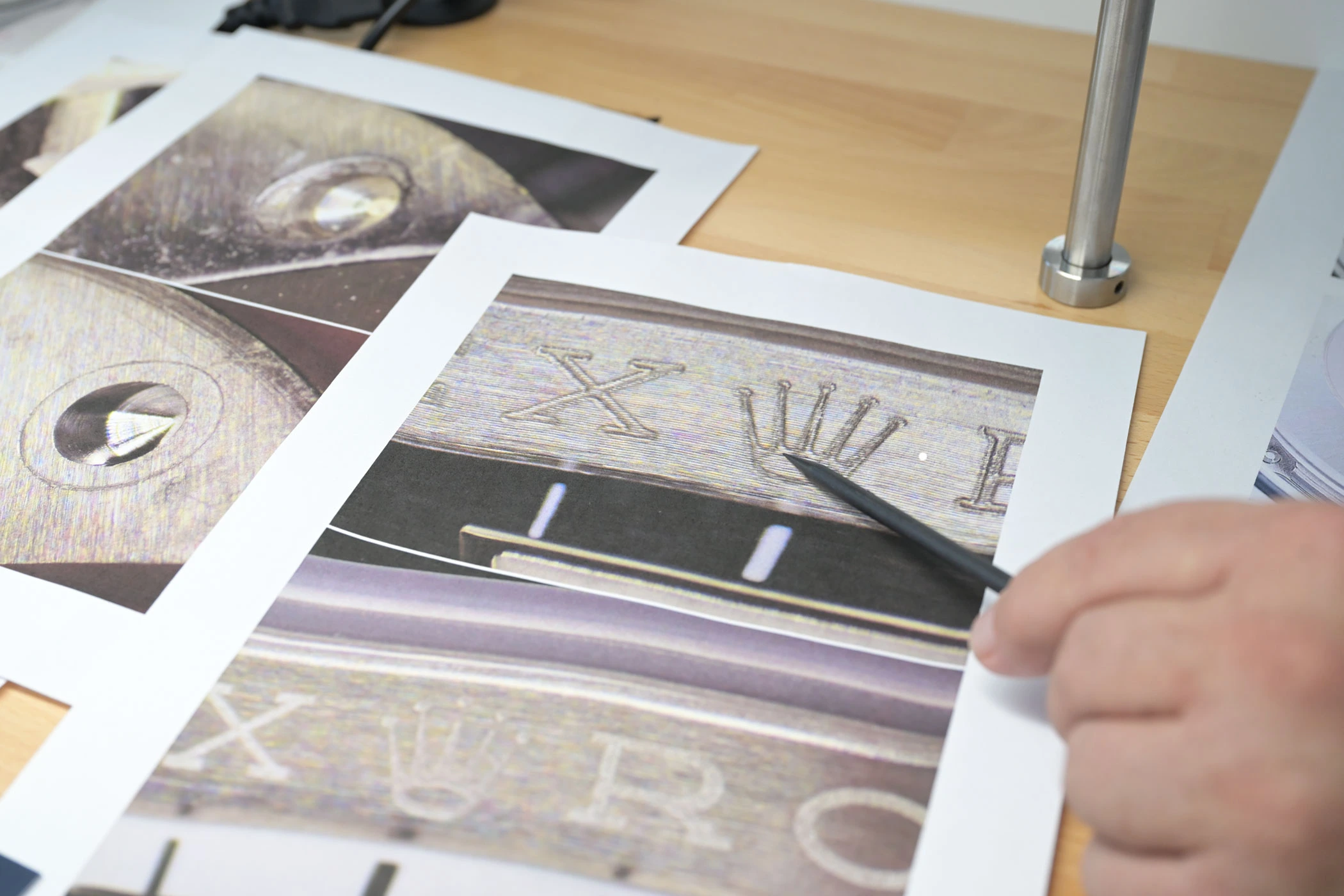

Certificates play an important role here, and they are not issued solely by the manufacturers. Chrono24, Chronext, Watchfinder & Co. all provide their own authenticity certificates. Jewellers can and do this as well, without requiring permission from the respective brands. Trust in the provider is therefore the first prerequisite if you are not acquiring a pre-owned watch through a brand programme. When buying from a jeweller, it can be helpful to also take a look at their new stock. If, for example, the dealer is an authorised Omega retailer, they are certified as such by the Swatch Group brand and receive original replacement parts. The prerequisite is that the dealer and their watchmakers meet certain requirements regarding workshop equipment and expertise. This know-how naturally extends to the pre-owned sector as well.

Global Growths Insights reports a worldwide trading volume for pre-owned watches of 22.84 billion US dollars in 2024, with a forecast of 23.71 billion US dollars in 2025 and 24.61 billion US dollars in 2026. The market analysis and research firm further expects the pre-owned market to reach 33.16 billion US dollars by 2034. Other studies predict even stronger growth, up to 43.7 billion US dollars by 2031.

For comparison: Global Markets Insight, a consulting and market research firm, reports a trading volume of 61.9 billion US dollars in 2024 for the primary market for mechanical watches, 64.8 billion US dollars in 2025, and 97 billion US dollars in 2034.

Other studies indicate similar growth rates. This means that whether new or pre-owned, classic wristwatches remain a globally expanding market segment, with the pre-owned sector growing faster than the primary market.

Mechanical timepieces – which make up the bulk of the second-hand market – have a huge advantage over nearly all other consumer goods: they combine a long lifespan, often passed down to the next generation, with the ability to be repaired repeatedly and restored almost to their original condition.

Regular servicing also helps to prevent signs of wear and tear in the long term – the best foundation for passing these ticking treasures on to new, happy owners. After all, a well-maintained watch doesn’t simply get old – it becomes more valuable, both in terms of appreciation and, ideally, in monetary worth.

The nascent history of the pre-owned watch market can be divided into three distinct phases:

Around 2018, the business of selling pre-owned luxury watches began to gain real momentum. Platforms such as Chrono24 and Chronext had by then established themselves and earned the trust of both sellers and buyers. Spending significant sums of money on an online purchase was no longer an issue.

At the same time, the international jewellery chain Bucherer, which has been part of Rolex since 2023, launched its own Certified Pre-Owned (CPO) programme with a guarantee and official authenticity check at its own points of sale.

In 2018, Bucherer also acquired the American retailer Tourneau, whose brick-and-mortar stores now operate under the Bucherer name. Tourneau is regarded as one of the first major dealers to have built a systematic offering of pre-owned luxury watches – as early as the 1990s.

That same year, Audemars Piguet announced its entry into the pre-owned market. When a brand of such calibre embraces a new segment, it can electrify an entire community – and that’s exactly what happened. Ever-growing waiting lists for certain models, combined with many brands’ increasing fondness for limited editions, did the rest. Demand quickly outstripped supply, and prices for some iconic timepieces kept climbing higher and higher.

This, of course, attracted media attention. Pre-owned watches made the leap from a journalistic niche into the bright glare of public fascination: from high-reach social media influencers and glossy magazines to serious news titles – all succumbed to the dynamic allure of the volatile pre-owned watch market, fuelling the hype even further.

Contributing to the frenzy were stories like that of a Rolex Daytona Paul Newman model bought by a US Air Force veteran in 1974 for around 375 US dollars – and never worn. When it was later valued at between 500,000 and 700,000 US dollars, the stunned owner threw himself to the floor in disbelief – on live camera.

But it wasn’t only the roller-coaster price developments that drew attention. When football superstar Cristiano Ronaldo invested in the platform Chrono24 in 2023, even those with little interest in watches began to take notice.

Long waiting lists and the business practices of so-called flippers, who purchased particularly sought-after new models solely for immediate resale at a huge mark-up, also made the market for pre-owned watches a favourite of the media.

‘This hype phase, from 2018 to 2022, attracted many new customers, collectors, and certainly a few opportunists. And it was good for the watch industry as a whole, because it generated enormous media exposure,’ recalls Tim Stracke, who, in 2010, took over Chrono24 with Dirk Schwartz and Michael Krkoska. He went on to lead the company for many years as co-CEO, helping shape it into one of the largest players in the pre-owned watch segment. He remains a shareholder and member of the advisory board today.

By now, the pre-owned watch craze has settled, and the pure speculators have found other playgrounds. The market, however, continues to grow relentlessly.

‘What remains are those who discovered their passion for watches through this hype. And new watch enthusiasts are still joining all the time,’ says Tim Stracke.

From 2020 onwards, the coronavirus had the world firmly in its grip for around two years. The mood was at an all-time low. But not the desire to shop. With lockdowns and travel restrictions lasting months in some cases, it was the online retailers’ moment to shine.

In addition to the availability of watches online, scarcity – many manufacturers had reduced production during the pandemic – and the search for both investment and tangible assets with emotional value in uncertain times played perfectly into the hands of the pre-owned watch market.

After a temporary slump at the start of the pandemic, activity on platforms and marketplaces surged more than ever. Some models changed hands at an 80 per cent premium over the recommended retail price. Overall, prices for luxury watches on the pre-owned market rose by around 70 per cent within just two years.

Brands such as Rolex, Patek Philippe and Audemars Piguet in particular fuelled this development. The discontinuation of iconic models such as the Royal Oak Jumbo by Audemars Piguet and the Nautilus Reference 5711 by Patek Philippe, both made of steel, further heated up the market. At the time, however, no one wanted to hear about a bubble that could burst at some point.

In the second quarter of 2022, not only were almost all restrictive coronavirus measures lifted. The price rally on the pre-owned watch market also came to an end. This also applied to models such as the Nautilus 5711/1A-010 from Patek Philippe and the Royal Oak Jumbo in stainless steel from Audemars Piguet, which had previously been among the hottest watches on the pre-owned market. Although the bubble did not burst, it clearly deflated in terms of prices.

This was because supply had also increased in parallel with rising demand. As a result, prices fell and the flippers moved on. However, prices did not plummet, but stabilised at a high pre-coronavirus level.

An analysis of the WatchChart platform, which evaluates the price development of 300 watches from the top 10 luxury brands, shows a steady downward trend from April 2022 onwards. However, prices now seem to be levelling off.

A slight decline of 0.2 per cent is reported for the past twelve months, while the last six months show an increase of 2 per cent. However, the current average value of around 40,000 US dollars is still significantly higher than the approximately 25,000 US dollars in 2018, when the price rally began.

Chrono24’s ChronoPulse evaluation tool is based on actual transactions and analyses the performance of the 14 watch brands with the highest transaction volume on the second-hand market. For the period from 2019 to the present, it shows an increase of a good 39 per cent. However, over the last twelve months, there has been a decline of 0.1 per cent, and over the past six months, the index has fallen by 1.6 per cent.

These are minor fluctuations that are normal for a large and diverse market. And with a few exceptions, there have been no major swings.

‘The price situation has eased and normalised. That was necessary and is a good thing,’ said Stracke in an interview with Swisswatches Magazine this summer.

When it comes to investing in a timeless, high-quality, emotionally charged product – in short, if you are a watch lover – then the answer is an unequivocal yes. If you view watches purely as a financial investment, you can certainly achieve good returns with some models. But you need a good nose and a lot of time. ‘I don’t currently advise anyone to buy watches as an investment,’ said Stracke in an interview with Swisswatches Magazine, ‘there are vehicles that are performing better at the moment.’

And are probably easier to calculate. This is clearly illustrated by the example of the Cubitus from Patek Philippe, which was launched in October last year amid much media hype and mixed reactions. The stainless steel version with an olive green dial, for example, entered the pre-owned watch market shortly after its official launch at almost three and a half times the RRP (40,557 euros). Since then, asking prices have fallen by between 20 and 40 per cent and currently range between 80,000 euros and 111,000 euros, which is still well above the RRP.

For all passionate watch purchasers, we have compiled an overview of some reputable suppliers of pre-owned watches, which are representative of many others. We have focused on multi-brand suppliers with reliable authenticity checks and/or certifications and excluded pure brand programmes such as those from Breitling, Rolex, Vacheron Constantin, Jaeger-LeCoultre, and Richard Mille.

Rather than making recommendations, we aim to highlight the differences between suppliers, which are quite remarkable.

There are now large marketplaces and hybrid retailers offering a huge range of pre-owned watches in all price ranges and categories. All of the providers presented below carry out authenticity checks and their own certifications. These are therefore not manufacturer certificates.

The online marketplace, headquartered in Karlsruhe with branches in Europe, Asia and the USA, was launched in 2003. Since then, around 1.6 million watches have changed hands via this platform. Chrono24 acts purely as an intermediary between sellers and buyers. Around 3,000 dealers and 60,000 private buyers offer their watches in more than 120 countries. Currently, around 420,000 pre-owned watches are listed. The majority of watches are priced between £2,000 and £10,000 (41.7%) ((< £500 (7.9%), £500-£2,000 (16.3%), £10,000-£20,000 (16%), >£20,000 (13.5%), price on request (4.6%)).

The brand portfolio is vast, ranging from affordable fashion watches from brands such as Fossil and Lacoste to mid-priced mechanical models from manufacturers such as Seiko and Nomos to rare collector’s items from traditional brands such as Patek Philippe and Jaeger-LeCoultre.

Advertising on Chrono24 is free for private individuals. However, a commission of 6.5 per cent of the sale price is payable on a sale. The purchase price is initially paid into an escrow account and is only released after confirmation that the purchased watch has been received in perfect condition. In addition, a 40-strong quality and security team constantly monitors the listings and investigates suspicious cases.

There are two forms of certification: by the seller according to Chrono24’s specifications (Certified by Dealer: marked with a green C in the listing) and by Chrono24 itself (marked as Certified by Chrono24). Since 2022, the latter has been carried out by the experts and watchmakers at Chrono24 Direct or by one of 200 partners worldwide and is offered for a fee for watches priced at 5,000 euros or more.

Watches are considered authentic if they are either in their original condition or have no more than two replacement parts that do not originate from the manufacturer and do not bear a trademark. Permitted aftermarket parts are: crown, bezel, hands or pushers. The certificate of authenticity includes a guarantee of authenticity, which is valid for 30 days from the date of issue.

Chrono24 lists other services such as free valuation based on advertisements, digital monitoring of an individual watch selection including market price development (Watch Collection) and commission sales. In addition, sellers and buyers receive personal support for particularly high-priced transactions.

Founded in 2013, the company has so far assisted around 175,000 customers in 60 countries with the purchase and sale of pre-owned watches. In November 2024, Chronext was acquired by The Platform Group, a software company for platform solutions based in Wiesbaden. Since then, a restructuring process has been underway with the aim of reducing the company’s own purchasing and sales activities, and instead focusing on commission-based business and a marketplace approach.

Currently, the company offers commission-based sales, direct sales, and trade-ins. On average, the pre-owned range comprises 7,000 watches. The majority are in the price range between £10,500 and £13,500. However, the current range starts in the three-figure euro range, goes up to around £250,000, and comprises around 80 brands.

For individuals, selling through Chronext incurs transaction costs in the form of a commission, which is agreed individually depending on the model and selling price. For commission sales, a sales fee/commission is charged, the amount of which is determined by Chronext based on the watch (model, condition, features, etc.). A valuation is provided free of charge.

Every watch passes through the in-house workshop in Cologne, where it is checked for authenticity and condition by the watchmakers there. A 24-month Chronext warranty is then issued. In addition, a comprehensive watch service and repairs are offered. Purchased watches can also be collected in person from the Chronext lounges in Cologne and Munich.

Established in 1995, the online marketplace with its colourful logo is familiar to many. Known for its extensive range of products from private and professional sellers, the US company expanded into the second-hand watch market around 2018 and developed targeted programmes.

Several hundred thousand watches in all price ranges and categories are currently listed worldwide. Ranging from starting prices of one euro at auctions to watches with fixed prices in the upper six-figure euro range. Accessories and original parts are also available.

Buying and selling on eBay is free for private individuals. Integrated payment processing and eBay buyer and seller protection also ensure secure transactions.

Private individuals are not charged for the eBay authenticity verification introduced in 2019. After purchase, this is carried out on around 70 selected brands – from A. Lange & Söhne to Zeppelin – with a sales price of 1,800 euros or more at the eBay verification centre in collaboration with Stoll & Co., a provider of watch repair services for manufacturers, jewellers and end customers. The watches are checked against a checklist and their condition is compared with the description in the listing. Finally, the watch receives an authenticity card with a QR code that can be used to access all the details that have been checked. This is linked to eBay’s unlimited Authenticity Guarantee.

As an additional service, eBay offers an AI-supported sales process with suggestions for item descriptions and image editing options.

Founded in 2002, the British online retailer was acquired by luxury goods group Richemont in 2018 and, like Chronext, now relies on a hybrid business model with a marketplace, buying and selling, and trade-ins. It offers thousands of watches from over 70 brands in the price range of currently 500 to 620,000 euros, which are available online and in 17 boutiques and showrooms in eight countries.

All watches are inspected, authenticated, refurbished, and provided with a 24-month warranty by watchmakers at one of three Watchfinder service centres in the UK, EU, and US, which are certified by 19 watch manufacturers. A service fee is charged for this, depending on the amount of work involved.

However, sellers are offered a free collection service from their home after everything necessary for packaging has been sent to them in advance.

Those who want to personalise their watch purchase can now take advantage of the offerings of many jewellers, from classic family businesses to internationally active chains. Many supplement their in-store personal consultation services with an online shop.

The range of watches on offer here is smaller than on the aforementioned platforms, but the advantage is that you receive very personal advice and quick information about exciting new arrivals. With the exception of Bucherer, authenticity guarantees and similar assurances are not provided by the manufacturer, but by the respective retailer.

The Stuttgart-based jeweller is one of the pioneers when it comes to trading in pre-owned watches. According to their own information, they have been active in the pre-owned watch sector for almost 50 years. Their business concept includes buying and selling, trade-ins and private-to-private sales via Rent a Juwelier. With the latter, sellers can offer their watches anonymously in their own window display for 25 euros per month at Juwelier Häffner and for an additional 20 euros in the associated online gallery. If the sale is successful, the commission is 15 per cent.

On average, there are around 1,000 watches to choose from. The focus lies on watches within the 3,000 euros to 50,000 euros price range. All the well-known luxury watch brands are featured, from A. Lange & Söhne to Zenith, but also brands from the lower and middle price segments such as Tissot, Junghans, Citizen, and Seiko.

Each watch is thoroughly examined, serviced, and, if necessary, refurbished and overhauled in our own watchmaker’s workshop. The condition, movement, case, and accessories are then documented in a numbered watch passport with a colour photograph and the replacement value. For watches valued at 1,000 euros or more, Juwelier Häffner provides a 1,000-day guarantee. As a special feature, Häffner offers the option of pawning a watch through its own pawn shop.

Founded in 1978, the family-owned company is based in Stuttgart and has branches in eight other German cities. In addition to its expertise as a jeweller, it has also made a name for itself as an auction and trading house for pre-owned luxury items such as watches.

The auctions are aimed primarily at collectors looking for rare models or attractive opportunities. The offerings on the website and in the showrooms are aimed at interested parties who want immediate availability, personal advice and a fixed price.

Following extensive renovation work, the company has just opened new premises in Stuttgart with a jewellery shop, a sales area for pre-owned designer fashion, luxury handbags and high-quality accessories, as well as an auction area. You can sell your watch either directly to Eppli, on commission or through regular auctions.

An average of 400 to 500 watches are available for sale, all of which come with a 24-month warranty. In addition, around 1,000 timepieces go under the hammer each year. Prices start at 200 euros for entry-level models, but the majority are priced between 2,000 euros and 50,000 euros. Collectors’ items in the six-figure range also regularly find their way into Eppli auctions.

Each watch is inspected by watchmakers in their own workshop. The condition and authenticity of the watches are then documented. Watches that have been checked in this way receive the Certified by Eppli label, which guarantees their authenticity.

The internationally active Swiss jewellery chain, which has been part of Rolex since 2023, launched the Bucherer Certified Pre-owned programme in its Geneva store in 2019 and has since expanded it to more than 50 locations in Europe and the United States. Bucher focuses exclusively on buying and selling in its own stores and via its website.

The range comprises several thousand watches worldwide, for beginners as well as collectors of exclusive models. The focus (excluding Rolex) is on the price range between 2,000 euros and 15,000 euros. A good 20 brands are listed. In addition, there is Rolex with several hundred watches currently priced between approximately 5,000 euros and 110,000 euros.

If you want to sell your watch to Bucherer, it will be accepted in exchange for a trade-in voucher after an initial inspection. The Bucherer experts then authenticate the watch, ensure its functionality or service it, and repair it using original parts. Certified CPO watches come with a 24-month Bucherer warranty. For some brands, such as Rolex and Vacheron Constantin, a manufacturer’s certificate is issued instead.