For the first time, the Concours of Elegance is being held in Germany. We visited the main sponsor, Lange & Söhne, at Tegernsee.

At first glance, the Vaucher Manufacture Fleurier looks like your archetypal Swiss watchmaking manufacture. Bright, modern white rooms play host to advanced machines, exquisite movement decorations are proudly displayed in all their glory, employees pose by solar panels citing sustainability pledges. Yet, beneath this spotless exterior lies a complex and highly sought-after entity within the watchmaking world. Indeed, it’s one of the most prominent yet simultaneously ill-informed conversations in the industry right now: what exactly makes the Vaucher manufacture so valuable, what makes it a risk – and why might some of the world’s wealthiest investors be hoping to get their hands on it?

First things first: Vaucher Manufacture Fleurier is not a watch manufacture, but rather a complete movement maker. Established in 2003 as a ‘spin-off’, if you will, from Parmigiani Fleurier, the company is primarily (75 percent) owned by the Fondation de Famille Sandoz and has been partially owned by Hermès International since 2006, when the latter invested 25 million Swiss francs to acquire a 25 percent stake in it. Today, Vaucher counts coveted brands such as Richard Mille, Corum, Audemars Piguet, Speake-Marin and Baume & Mercier amongst its clients, and is home to over 200 highly trained employees – or 500 if one were to count its sister companies.

The Sandoz Family Foundation is known for its vast and varied investments. A quick glance at Bloomberg reveals that the affluent private Swiss foundation has dallied in everything from financial services, hotel businesses, telecommunications companies and graphic arts to drug companies. It holds stakes in a number of prolific and inevitably lucrative Swiss businesses – think drug-making giant Novartis, private Genevan bank Banque Edouard Constant, Hôtel Palafitte, Beau-Rivage Lausanne – and, of course, Parmigiani Fleurier. The latter, however, was not always so lucrative.

Once known only to the utmost connoisseurs – King Charles III and his Toric Chronograph being one of them – there was a time where the name of this quietly brilliant brand had a fair number of people enquiring if it was a certain Italian dish. These days, however, not least since the appointment of CEO and watch icon wunderkind Guido Terreni (formerly behind Bulgari’s phenomenally successful Octo Finissimo watches), Parmigiani Fleurier has become something of a household name well beyond collector circles. Its Tonda PF model has fast become one of the most desirable dress watches on the market; according to Bloomberg, the new-generation Tonda line accounted for 98 percent of the brand’s sales in 2023.

It is largely assumed that prior to Terreni’s hiring, Parmigiani Fleurier was not actually making profits, while the Sandoz family is thought to have offset its losses. By contrast, according to Swiss financial journal Bilanz, Parmigiani Fleurier’s turnover now stands at around 65 million Swiss francs. An asset in its own right at long last, one might think.

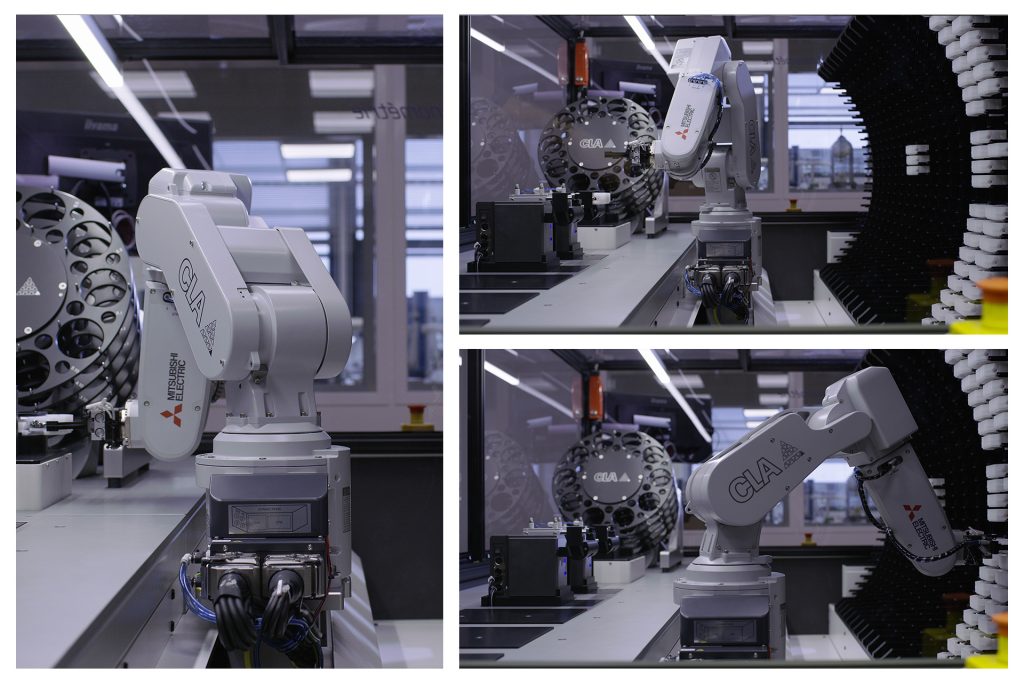

Most Vaucher components are produced either in-house or within the aforementioned network of sister watchmaking companies under the Sandoz Family Foundation. Atokalpa, for example, manufactures wheels and critical assortments, including the escapement and balance spring – a rarity that a mere handful of Swiss manufacturers can offer. Meanwhile, Elwin specialises in micro components such as screws and pins. Quadrance et Habillage produces high quality dials, while the equally well-respected Les Artisans Boîtiers makes cases. This leaves Vaucher to create everything else that goes into the movement: think base plates, bridges, and wheels, as well as exquisite traditional calibre decoration and, naturally, the engineering of the movement itself.

Unlike your typical third-party supplier for base movements such as Sellita or ETA, Vaucher specialises in a range of complete movements, and enjoys an excellent reputation for its work with ultra-thin movements, often employing micro-rotors while simultaneously implementing complicated additions such as tourbillons and moonphases. The manufacture plays host to five main movement lines.

One classic automatic movement is the Seed VMF3002, which Vaucher dubs its ‘timeless classic’. The calibre, which has been employed by Speake-Marin for its Velsheda models, houses a double barrel, allowing it to deliver a more regular energy to its variable inertia balance. Meanwhile, the sleek Seed VMF 5401 calibre is an extra-thin (2.60 mm) movement enabled by the integration of micro-rotor. Robust and slim, the often-modified movement has its home in a range of prestige watches such as Baume & Mercier’s handsome Clifton 18030 Perpetual Calendar.

Vaucher’s key chronograph calibre, on the other hand, is the Seed VMF 6710, an integrated chronograph. Its construction combines a high-frequency balance, a column wheel, a vertical clutch, and a linear hammer. Allowing for 1/10th of a second precision, it also integrates full cock with twin supports to ensure stability and shock resistance, and is rounded off by a gold rotor that helps to achieve a 65-hour power reserve.

Also excelling in the creation of tourbillons, Vaucher offers two other noteworthy lines. The Seed VMF 3024 stands out as a self-winding, flying tourbillon, boasting a double barrel, titanium cage, and variable inertia balance. Despite its slim profile, it remains precise and robust, with a gold oscillating weight and exceptional finishes that elevate it to an extraordinary level. Meanwhile, the Seed VMF 5430/22, which is actually one of the world’s slimmest tourbillons at 3.4 mm, impresses with its innovative construction and avant-garde design. Its remarkable opportunities for personalisation and the modern yet timeless aesthetics of its finishes make it a standout piece in horological engineering. The manual-winding movement’s titanium tourbillon cage further enhances regulation performance and thus precision.

No matter what the movement may be or indeed become in the case of modification, Vaucher also carries out internal quality controls, as well as certifying the calibres according to their clients’ requests, from COSC to the ‘Qualité Fleurier’.

No wonder the Vaucher Manufacture Fleurier and its counterparts form such an attractive asset as one singular, formidable watchmaking entity. This brings us to the hot topic of the moment. Several months ago, publication Miss Tweed declared, allegedly with first-hand sources, that the Sandoz Family Foundation was ready to sell Vaucher alongside several of its other watch enterprises. Swatch Group, Richemont, and LVMH have frequently arisen in conversation as potential buyers. Then there’s Hermès, which, with its particularly vested interest in Vaucher, is surely a strong contender. With that in mind, let’s dig into some of the theoretical options – with strong emphasis on the theoretical!

First and foremost, the elephant in the room: Hermès owns a good 25 percent of Vaucher already, enabling it acquire and modify its movements. Hermès already has a strong umbrella of other production companies, from its first 32 percent stake in the case maker Joseph Erard Holding made way back in 2011, or the slightly more recent acquisition of the Swiss dial maker Natéber – resulting in the creation of Les Ateliers d’Hermès Horloger. The company is rumoured to have made a bid to purchase the manufacture several times before, only for its offers, perhaps not high enough, to have been rejected. Yet as Vaucher’s appeal rises, could it be prepared to up the stakes? After all, the alternative might result in Hermès losing control over its claims to ‘in-house’ creations.

Then there are Vaucher’s coveted clients, including its leading client, Audemars Piguet, as well as Richard Mille – both vastly wealthy brands that already make use of the manufacture for certain production processes. Audemars Piguet in particular can be counted as an indispensable client of Vaucher, assisting in the production of between 50,000 and 60,000 movements per year. Meanwhile, Chopard and Patek Philippe could well both be shareholders in the Sandoz Family Foundation’s watchmaking subdivision, known as the ‘Pôle Horloger’ – most likely in Atokapla and Elwin. The newspaper Le Temps – notably once owned by the Sandoz Family Foundation, before being sold to Allegra Capital, a fund specialising in takeovers of loss-making companies – has some input. According to the paper, the consulting firm Deloitte has been hired to find the best possible buyer for the Vaucher entities. The article also muses over whether a number of these brands, say Hermès, Audemars Piguet and Richard Mille, could unite to block other potential buyers. If that were to happen, where might the future of Parmigiani Fleurier, which has only been standing on its own two feet for a couple of years, stand?

Meanwhile, just a few weeks ago, the Swatch Group may have seemed like a strong contender. However, a recently published report might make us think otherwise. The company recently revealed that it has suffered a shocking 70 percent drop in operating profit and 14 percent drop in sales during the first half of this year – largely due to China-led slump in luxury. As revealed by CEO Nick Hayek, production is already being cut by at least 20 percent as a result. With entry level brands such as Swatch proving more popular than pricy luxury brands such as Omega, a move to significantly invest in one of the top luxury movement producers would be a courageous move, not least at a time when luxury brands are proving comparatively less successful than their entry level counterparts. In addition, let’s not forget that the Swatch Group already has several of its own impressive integrated production facilities.

Under the savvy leadership of Bernard Arnault, LVMH has consistently aimed to expand its luxury watchmaking portfolio in the past few years. Although LVMH sold off most of its own 23.2% stake in Hermès back in 2014, it does still hold a stake (a not insubstantial two percent), which could provide a strategic advantage in acquiring Vaucher. Furthermore, Arnault’s move to take an equity stake in Richemont – something we’ll take a closer look at in a moment – also reflects Arnault’s well-known appetite for new ventures. Let’s also not forget that LVMH’s TAG Heuer brand is on a mission to upgrade its watches and lift them into a higher price segment, a move that is partly possible thanks to TAG recently making the Vaucher manufacture a vital pillar of its high-end watchmaking strategy. Indeed, its recently introduced Monaco Chronograph split-seconds watch, retailing at a hefty and unprecedented 135,000 euros, was created in collaboration with Vaucher.

Image credit: Jérémy Barande / Ecole polytechnique Université Paris-Saclay/CC BY-SA 2.0/Wikimedia Commons

It seems Arnault is on something of a luxury investment shopping spree. In June of this year, reported Bloomberg, the billionaire took an equity stake – albeit an allegedly small one – in Richemont, thus extending his hand beyond his LVMH kingdom and right into one of its competitors. This followed ambiguous comments pledging to ‘be there’ for Richemont chairman and ‘Cartier’s Kingmaker’ Johann Rupert (who holds about 10 percent of Richemont’s equity and 51 percent of the voting rights), should he need support. So, the question remains: are his sights set on Richemont, or can we expect one of the world’s richest men to capitulate and temporarily settle for the significantly smaller but nonetheless valuable Vaucher?

Image credit: Szekszter/CC BY-SA 3.0/Wikimedia Commons

In any case, an acquisition by the likes of the Swatch Group, Richemont or LVMH could have equally hefty repercussions for competitors such as Hermès, Richard Mille and Audemars Piguet.

Finally, a recent report by Morgan Stanley filed in collaboration with WatchCharts underlined that it’s been a tough year for luxury Swiss watch brands, which could likely lead to an overall cautious approach in the coming months. Indeed, no luxury Swiss watch brand with an average market price exceeding 3,000 dollars saw a positive performance in the second quarter of this year. LVMH brands’ prices dropped by 3.6 percent, while Richemont also, according to Forbes, ‘faced significant declines’ in the past few months. Overall, the the secondary market for Swiss luxury watches experienced a 2.1 percent quarter-over-quarter price decline in the second quart of this year. Is this the climate for substantial manufacturing investments to be made?

Vaucher Manufacture Fleurier’s value primarily lies in its prestigious client list and extensive production capabilities. Furthermore, Vaucher’s strategic partnerships position it as a pretty desirable acquisition target – yet as the watch industry continues to navigate financial challenges, it is hard to predict how various conglomerates and brands might approach future investments in these perturbingly unpredictable times. There are also many questions that remain unanswered: could Vaucher’s sister companies be split up? Sold as one entity? Might one ambitious brand, for example Breitling, simply take the plunge tout seul? What conflict of interests might arise? Whether Hermès, LVMH, or another elusive business titan manages to secure this gem of a production facility remains to be seen. One thing remains clear: Vaucher Manufacture Fleurier’s unyielding allure for the world’s top investors and luxury conglomerates is not going away any time soon.